You might believe that since your strategy has an edge it is guaranteed to work. If you were an algorithmic trader that only traded from a computer program, this would probably be true. You give it a set of rules, and it executes for you. However, if you are discretionary - meaning you take trades yourself - you might run into a few problems.

One reason that your strategy doesn’t work is because you’re borrowing someone else’s edge. Let me explain:

Systemic vs Discretionary Trading

There are two types of traders: systemic and discretionary. Systemic traders require a set of rules to enter a trade. The most extreme example of this would be algorithms since they execute on command. Discretionary traders rely on intuition and experience to take trades, with little or no specific rules required. Most traders end up being somewhere in the middle.

Although pure systemic trading might seem to be a better option, it has its downsides. The main downside is that it lacks flexibility. The markets are a changing environment and require constant adjustment and adaptation. There isn't one system that will work in all situations. This is why systemic trading using AI has not completely taken over (yet). Human input and intuition are still valid.

Purely discretionary trading for a beginner trader is no different from gambling. An experienced trader may have developed a sufficient amount of intuition to be purely discretionary after years of experience, but a beginner does not have enough intuition to do the same. A combination of systemic and discretionary would work best for most.

Borrowing an Edge

A profitable strategy from a successful trader usually lies somewhere in between. Most of these strategies are simple, but not generic. This means there are subtle elements of the strategy which allow the trader to minimize losses and maximize gains. The strategy would probably not fare as well if it was generic, like buying when the 50 EMA crosses above the 200 EMA. A trader would have likely spent years modifying and tweaking a simple strategy to be profitable.

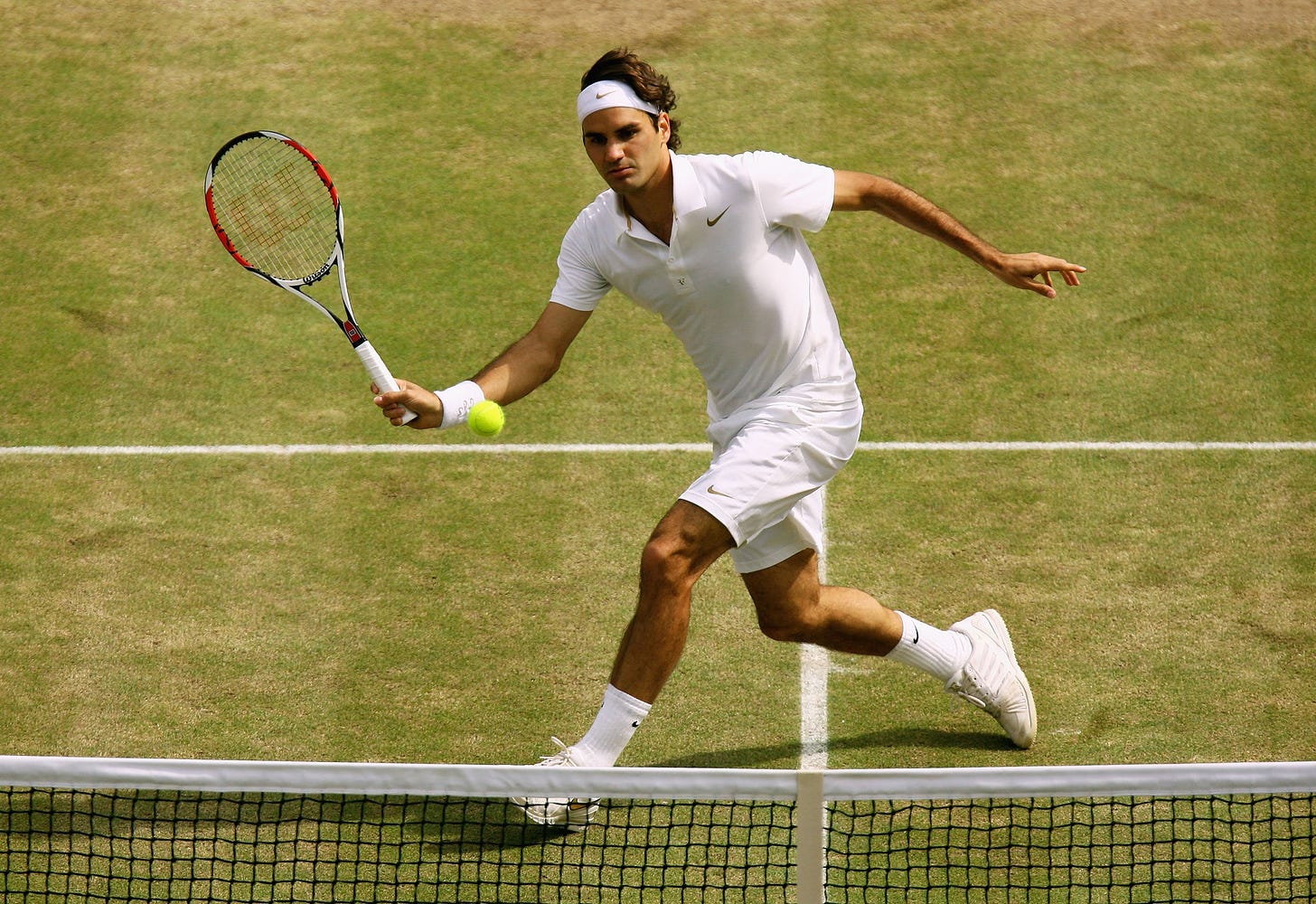

This is why you can't 'borrow' someone's edge. A strategy that you find from another trader is an extension of themselves. It's the many years of work they put in to develop it. For the same reason, you can't copy the moves of a professional in any field. When you watch Roger Federer play tennis, it looks easy.

You say to yourself: "that doesn't look so hard, I can do that!" In reality, it's very difficult. He might just be swinging a racket to hit a ball, but that swing has been perfected by years of practice. There are many other factors behind the skill.

In the same way, when you're borrowing a strategy, you're looking at the surface level of what is required to trade profitably. You're looking at the swinging of a racket on TV. The rules from the systematic aspect of a strategy can be replicated, but not the hours it took to develop the discretionary aspect.

For your strategy to work and be profitable in the long run, you must develop alongside it. You can't impersonate a profitable trader by using their strategy. You can't become as good as Roger Federer by copying his moves. The discretionary and systematic aspects must be developed over time for you to be sustainable.

It doesn't matter which strategy you pick, what matters is going through the experience and difficulties that transform you into a trader.

- Tradewriter

Disclaimer: Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions and notes. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.