Good afternoon folks,

Hope you had a great trading week - it was an interesting one. The High-Roller Room is now open. You should have received two discounts yesterday - one for free subs and one for paid subs. The promo codes expire Monday night. Trading begins on Monday. See you inside ;)

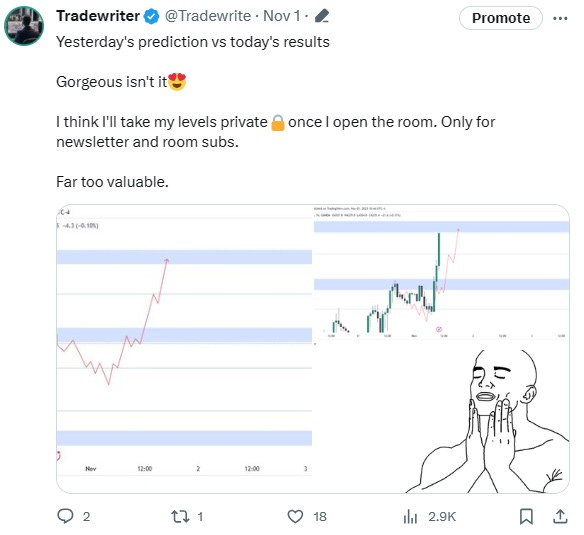

We had one of the largest short squeezes of the year, with five straight green days in a row. There was barely any room for bears to breathe. It reminds me of my findings when I backtested the S&P:

Trading with the trend is more important than you think. There are times where it’s better to go long 7 times in a row than even trying to attempt a short & vice versa

This week was one of the best examples. Irresponsibly spamming the buy button would’ve outperformed the most intricate short strategy. We caught most of the move long:

Outlook for Next Week

I trade the S&P 500 index daily and use supply/demand levels as my main strategy. I focus on a handful of core setups within these levels (found here) which typically appear 1-3 times a day. I take one or two trades a day, targeting gains of 10-30 points. My objective is to maintain consistency and leverage it, rather than trying to get as many points as possible.

Most were blindsided by the magnitude of this week’s move. Even many who were long were surprised. We cleared almost 300 points. Next week, we can expect a cool-down, followed by another major move. Key support short-term is 4300. From 4300, we can determine if next week’s pattern will continue “filling out” downward or if it will break and continue climbing upward.

Since we day trade, we don’t have a weekly bias. We reset it every day. We will trade whatever setup presents itself, bear or bull. Trade setups, projections, and intraday levels are found on the paid substack, as well as supply/demand education so you can trade self-sufficiently (subscribe button below).

Chart:

This is not a precise prediction, just a general outlook of where price action could go next.

That’s all for this week’s outlook. Stay sharp.

- T

Disclaimer: Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions and notes. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.