Good afternoon folks,

It was a short but fast-paced week as bulls continued their run higher, shocking even themselves with how far they’ve come. We rallied an additional 70 points this week, coming very close to the highs of the year.

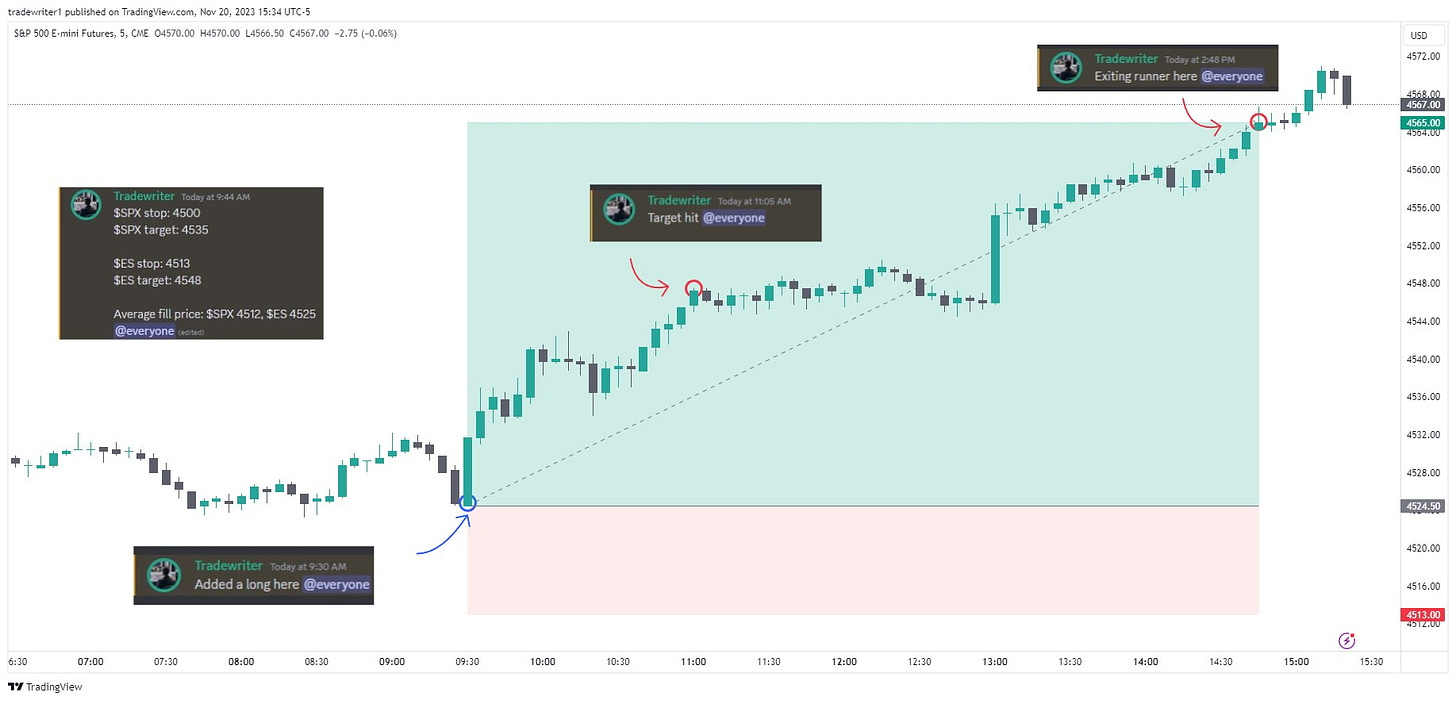

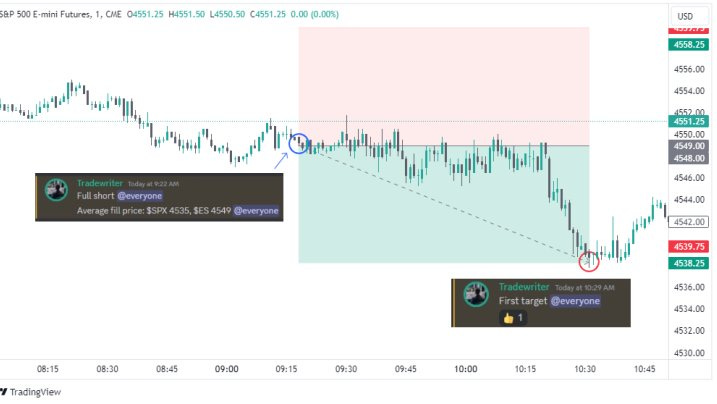

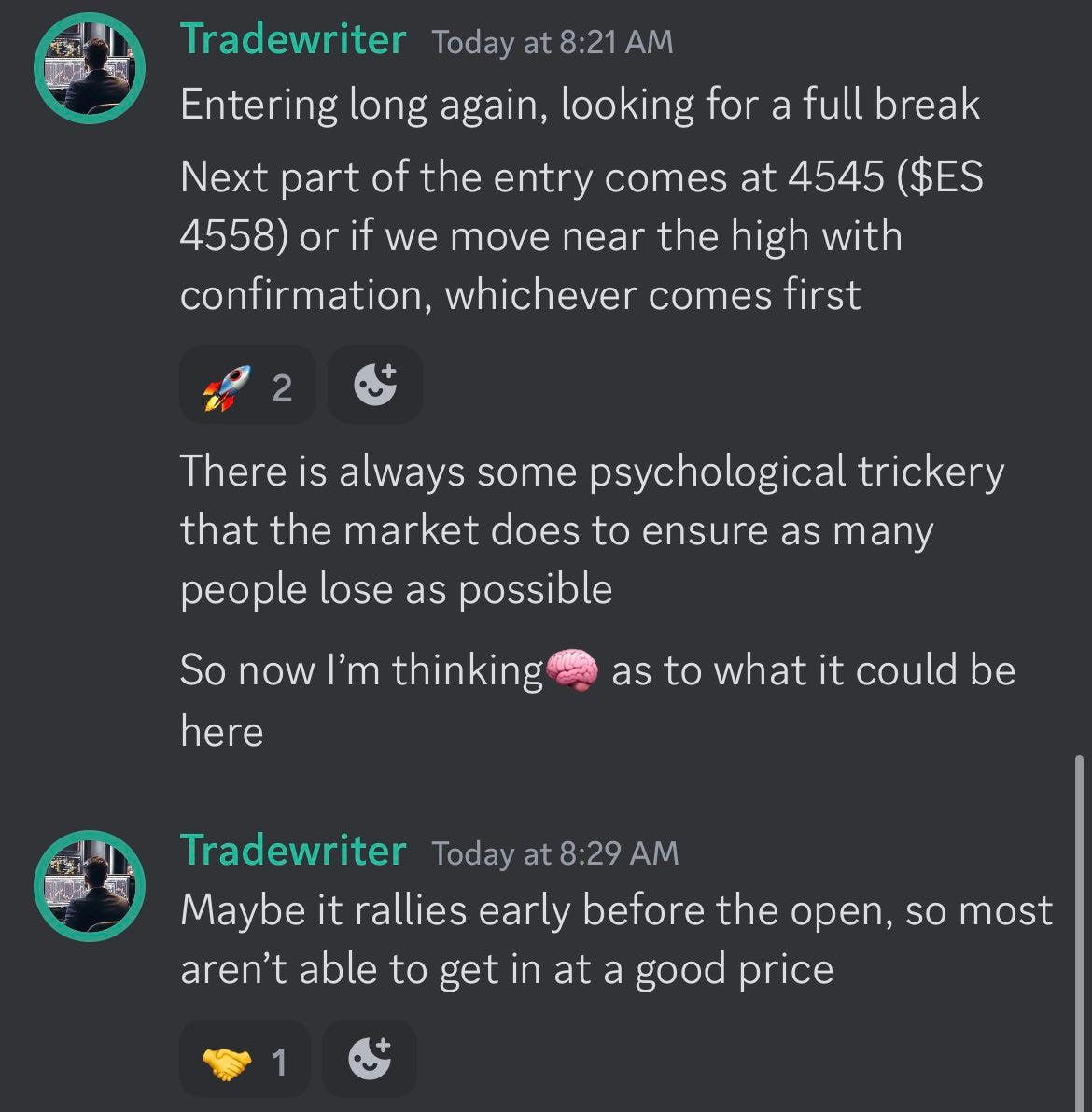

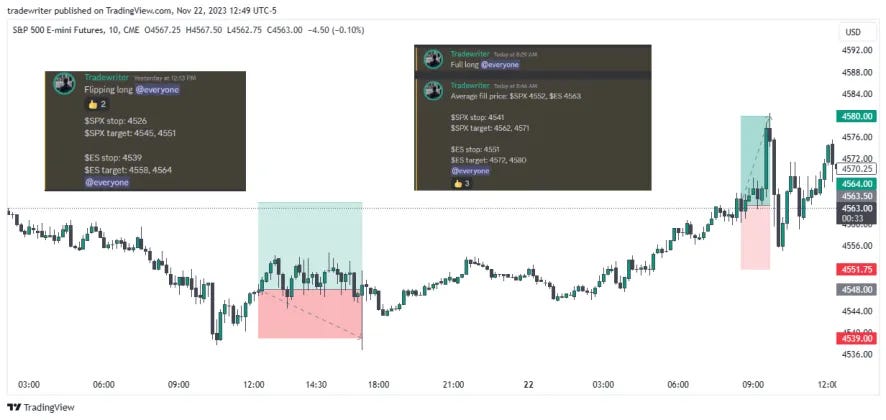

In The High-Roller Room, we captured a large portion of this move and secured profits. Here’s a recap:

Get access to the room here: https://whop.com/the-high-roller-room/

Lots of more content and education will be added shortly. I might be raising prices soon.

Outlook for Next Week

I trade the S&P 500 index daily and use supply/demand levels as my main strategy. I focus on a handful of core setups within these levels (found here) which typically appear 1-3 times a day. I take one or two trades a day, targeting gains of 10-30 points. My objective is to maintain consistency and leverage it, rather than trying to get as many points as possible.

Here’s last week’s projection:

Here are this week’s results:

I gave 4490 as a key level last week. As long as we stayed above, we were eligible to trade 70-150 points above. We traded ~80 points higher. This is exactly what happened. Now we’re dangerously close to yearly highs. The key level for next week is 4600. The importance of this level cannot be understated. It’s near the high of 2023. Past this level, we are very close to breaking all-time highs. This is decision time. It will affect the market far into the future. A break of 4600 will trigger another 50-100 points and a failure to break 4600 will initiate a long-term pullback of 60-110 points.

Chart:

This is not a precise prediction, just a general outlook of where price action could go next.

That’s all for this week’s outlook. All of this will be updated and executed in real-time in The High-Roller Room (click here to get access). Stay sharp.

- T

Disclaimer: Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions and notes. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.