Good afternoon folks,

Hope you’re having a great weekend. We have less than ONE week left until the launch of The High-Roller Room. On November 3rd, I will send out a discount code to all free subscribers, and a special discount code to all paid subscribers. You must be subscribed to receive the code, it will only be sent by email.

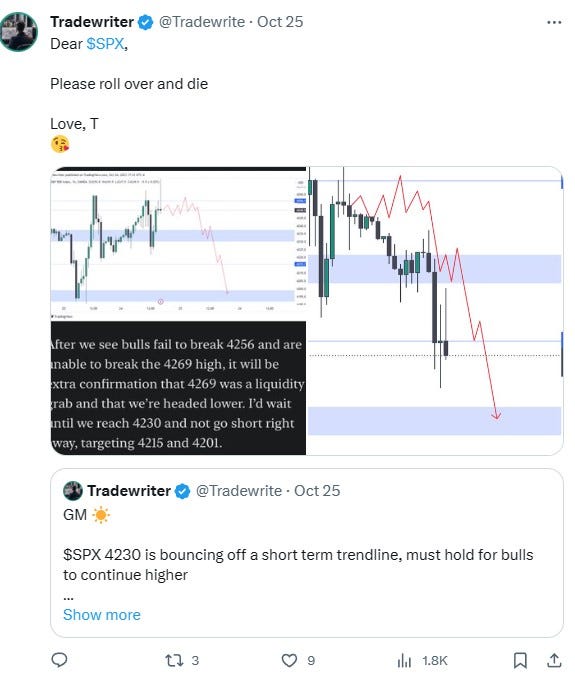

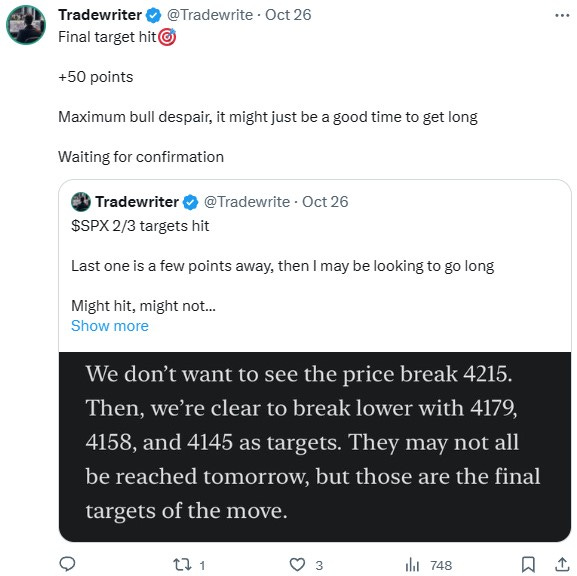

This week had incredibly bearish action - it was a mix of steep drops, chops, and weak oversold bounces. It was NOT a good environment to go long. There were a few opportunities, most of which we captured, but they were short-lived. We spent most of the week in shorts. Here’s a recap:

Outlook for Next Week

I trade the S&P 500 index daily and use supply/demand levels as my main strategy. I focus on a handful of core setups within these levels (found here) which typically appear 1-3 times a day. I take one or two trades a day, targeting gains of 10-30 points. My objective is to maintain consistency and leverage it, rather than trying to get as many points as possible.

Last week’s key level was 4200. This proved to be an immensely important level. We had a rally on Monday and Tuesday to knock out all the shorts from the week before and then proceeded to head 150+ points lower. Next week, the key level is 4140. A rally above this level will likely keep pushing us higher for another 70-120 points, while a failure to break above this level will result in more ranging/dropping. With the right conditions, we can continue dropping steeply for another 50-100 points.

Since we day trade, we don’t have a weekly bias. We reset it every day. We will trade whatever setup presents itself, bear or bull. Trade setups, projections, and intraday levels are found on the paid substack, as well as supply/demand education so you can trade self-sufficiently (subscribe button below).

Chart:

This is not a precise prediction, just a general outlook of where price action could go next.

That’s all for this week’s outlook. Good luck :)

- T

Disclaimer: Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions and notes. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.