Good afternoon folks,

We had a mildly choppy and one-sided week as the market slowly drifted upwards and broke SPX 5000 - a major milestone in the S&P 500’s history. There was very little downside action and barely any dips. Shorts were burned repeatedly trying to time the top.

In the High-Roller Room, we stayed consistent and waited for the right opportunity. No need to get chopped up - just know when to hold your position and let it play out

Outlook for Next Week

I trade the S&P 500 index daily and use supply/demand levels as my main strategy. I focus on a handful of core setups within these levels (found here) which typically appear 1-3 times a day. I take one or two trades a day, targeting gains of 10-30 points. My objective is to maintain consistency and leverage it, rather than trying to get as many points as possible.

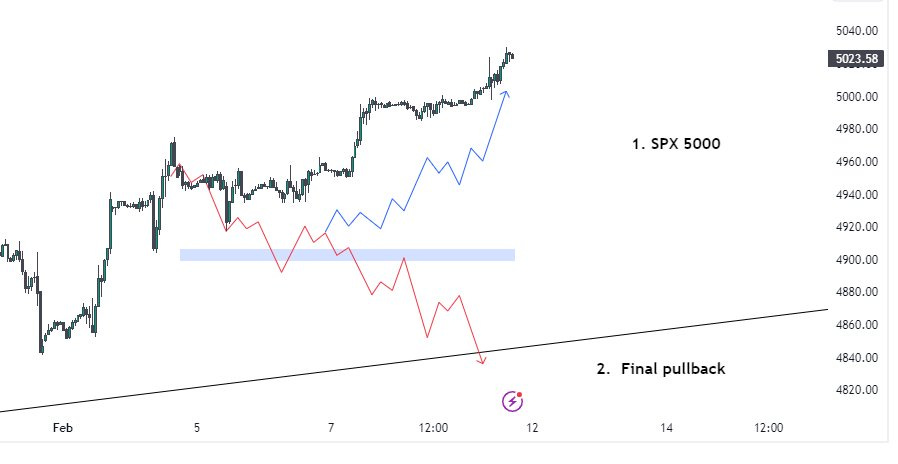

Here’s last week’s projection:

This week’s result:

The market went through very little pullback before climbing significantly higher and firmly breaking 5000. Most of the week was just a repeated cycle of sideways → up.

The key level for next week is 4900. Here’s my projection:

Blow-off top: The market breaks 5000, leading to a break of the overall trend structure which has been building for several weeks. Results in a swift and deadly drop. The downside risk increases drastically this week.

Parabolic: If 5000 holds, we can see parabolic action as the market heats up, moving up 50-100 points.

That’s all for this week’s outlook. All of this will be updated and executed in real-time in The High-Roller Room (click here to get access).

- T

Disclaimer: Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions and notes. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.