Good afternoon folks,

As the year wrapped up, we had a low-volume and low-participation week. It was a short week, and we spent most of it gradually climbing higher. It was not the ideal trading environment - lots of chop and a lack of opportunities. We had a sharp dump on Friday as the market gave back the week’s gains, followed by a small bounce and recovery.

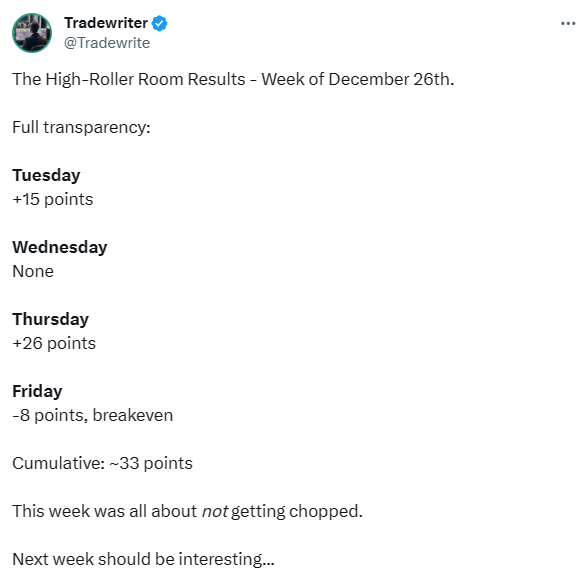

In the High-Roller Room, we read and traded the market accordingly. There was no reason to be overtrading - this would only result in getting chopped up. Instead, we adapted to the market by only taking a few trades and preserving capital.

Outlook for Next Week

I trade the S&P 500 index daily and use supply/demand levels as my main strategy. I focus on a handful of core setups within these levels (found here) which typically appear 1-3 times a day. I take one or two trades a day, targeting gains of 10-30 points. My objective is to maintain consistency and leverage it, rather than trying to get as many points as possible.

Here’s last week’s projection:

This week’s result:

Monday was Christmas, which is why I drew a flatline for that day. It looks a little delayed, but I expected the market to keep rallying as long as the 4740 area would hold. This is roughly what happened for most of the week until we dumped and bounced on Friday.

The key level for next week is 4760. Here’s my projection:

New-Year Ripper: As long as 4760 is held, we can expect the market to break through all-time highs and keep trending higher.

Deep Pullback: If 4760 breaks, the market could experience a deeper pullback and keep dropping. We could expect a re-test of 4700 and below.

That’s all for this week’s outlook. All of this will be updated and executed in real-time in The High-Roller Room (click here to get access).

Happy New Year!

- T

Disclaimer: Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions and notes. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.