Avoid the Death Spiral of the Gambler's Fallacy

Picture this: you're betting on heads in a coin flip. The coin has already been flipped six times, and each time it came out as tails. What are the chances that you'll get heads on this flip?

If it takes you more than a second to answer and you’re doing calculations in your head, you’re experiencing something called the Gambler’s Fallacy. This is when we believe past events influence present ones, and that a streak of luck will persist or that something is bound to occur.

The right answer is always 50% because the current coin flip is not influenced by past coin flips. Each coin flip is an independent event, it wouldn't matter whether it was the first or hundredth time flipped.

Gambler’s Fallacy in Trading

The inner workings of casino games like blackjack or roulette are similar to those of trading. The only way to succeed in these games is to have probability in your favor. For most games, this is impossible as the casino always has the edge. A few get lucky, but in the long term, the house always wins.

In trading, there are a few winners and many losers. The market itself is designed this way because it reflects human nature. You'll find that it always seems to move against you as soon as you get in. This is just human emotion.

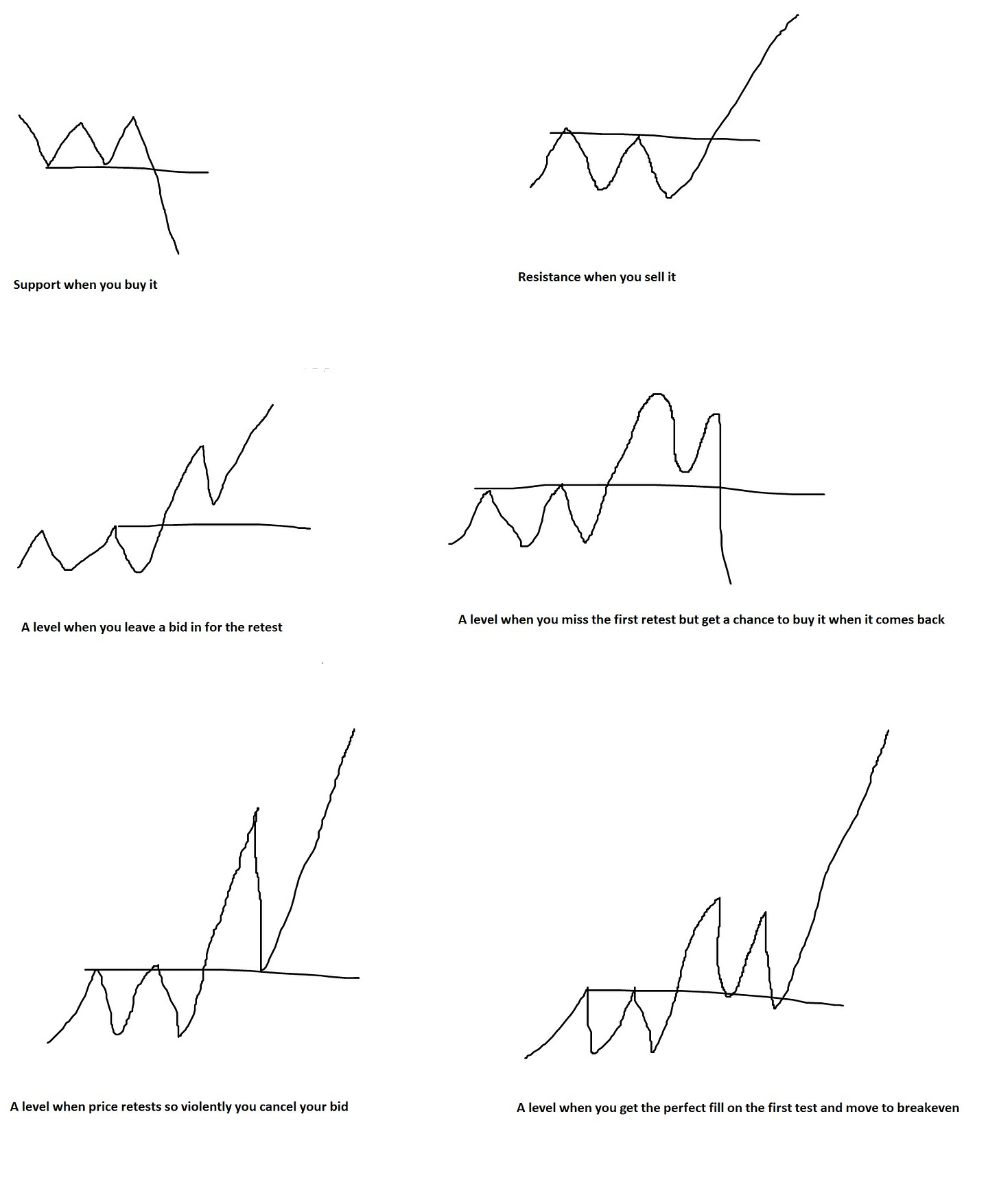

Once you see the price begging to rise quickly, your instinct is to get in the move so you don’t miss the takeoff. When you see price dropping hard, your instinct is to sell so you don’t suffer more losses. In both of these cases, the market will likely do the opposite. There are thousands of different variations of this, where you can never seem to get anything right:

The market can stay in different stages and do the opposite of everything you expect for a long time. Hence the famous phrase: “the market can stay irrational longer than you can stay solvent”.

The gambler’s fallacy is especially dangerous for bagholders, those who will hold on to their position no matter how much it goes against them. The most common example is those who buy a stock at a high price and refuse to sell it no matter how far down it goes. They believe that they’re eventually “due” for a bounce, and then it will make its way back up. It can’t go down forever… can it?

A few of those might never go up to where you bought them. This belief will cause an investor to be irrationally attached to their position and take huge unnecessary losses.

The Death Spiral

For many investors, the gambler's fallacy is a death spiral. It's like getting caught by a crocodile and being dragged to the bottom of a river. Every second that passes, your chances of making it back alive decrease dramatically. You're not only getting further from the surface, but you have a crocodile tearing you apart.

When an investor has a case of gambler's fallacy, their mind goes through the same process. If they're holding a stock and it drops significantly, they'll think about doubling down and catching bottoms instead of reducing their risk. As the stock falls, they get less likely to sell, just as you're less likely to survive the lower you get submerged. Why is this?

When the stock begins dropping, this investor continues to believe that the stock will bounce back. This belief gets stronger as the stock keeps dropping because they believe the stock is even more overdue for a bounce. If you get 7 heads in a row, then the 8th flip must be tails.. right?

When a stock drops significantly below your entry, the best decision is usually to accept the loss and move on. This would be the equivalent of escaping the crocodile and rising to the surface. You will have a few scars, but you're mostly intact and can live another day.

Bagholders will keep justifying their decisions, so they become a prisoner of their position. They can't stop themselves from being dragged under. They will rationalize any decision they make to keep holding on to the stock and appear 'right'. Whenever they get a chance to escape, they will turn it down and keep sinking.

To avoid this fallacy and the subsequent disasters it can create, remember that every trade should be treated as an independent trade.

The market is a highly random and chaotic environment and doesn't need to follow any rules. It will not adapt to you. Instead, you must adapt to it. Be free of any notion that it should follow a logical or rational path, and accept what it gives you.

Remember to build a system that takes advantage of market randomness, rather than become its victim. You will consistently extract profits and won’t feel a need to predict where moves will end or begin. Doing so is a guessing game that you’ll often end up on the wrong side of.

- Tradewriter

Disclaimer: Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions. Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.