I’m sure we’ve all experienced this pain before:

That feeling when you knew you were right and didn’t get rewarded for it, because you placed your stop loss a little too tight. This is especially bad in choppy markets, where both sides get stopped out constantly.

Stop-loss placement is one of the hardest things to do correctly in trading. Place it too tight… and the above happens. Place it too far and you’ll ruin your risk/reward and profitability in the long term.

How do we solve this issue? After continuously running into this problem, I developed a solution so that I almost never get stopped out. When I do take a loss, I know it’s because my setup was wrong, not because my setup was right with the wrong stop loss placement.

You probably have a good instinct about market direction, but can’t find a way to apply it without getting whiplashed. By following this method, you’ll find a way to get the profits you deserve:

Why Does This Happen?

The market, by nature, is designed to stop you out. We’re all looking at the same chart. If you see a nice-looking setup, there are thousands of others who see the same nice-looking setup. If everyone enters at the same time and place, it leaves a lot of room for traps.

Since most place stop losses right under their entry, bigger players can temporarily push price to hit those stop losses. This causes lots of buying and selling activity, which they can then use as a launch pad to move the price in its original direction.

Whether it’s unethical or not, this is the nature of the market. It always moves in the direction that causes the most pain for the most people. If everyone expects the market to go down, and there are lots of short positions at a certain level, we will most likely surge upward and take out those shorts.

Think about it - if there is no one left to sell, we can only go up. Most people get this backward, hence the 95% loss rate of traders. We need to ignore our nature and listen unquestionably to what the market is telling us because that’s where our profits will come from.

How to Avoid Getting Stopped

There are two ways to avoid getting stopped. The first is to zoom out to a higher timeframe and have a point of failure. Be clear with your thesis and analysis. For example:

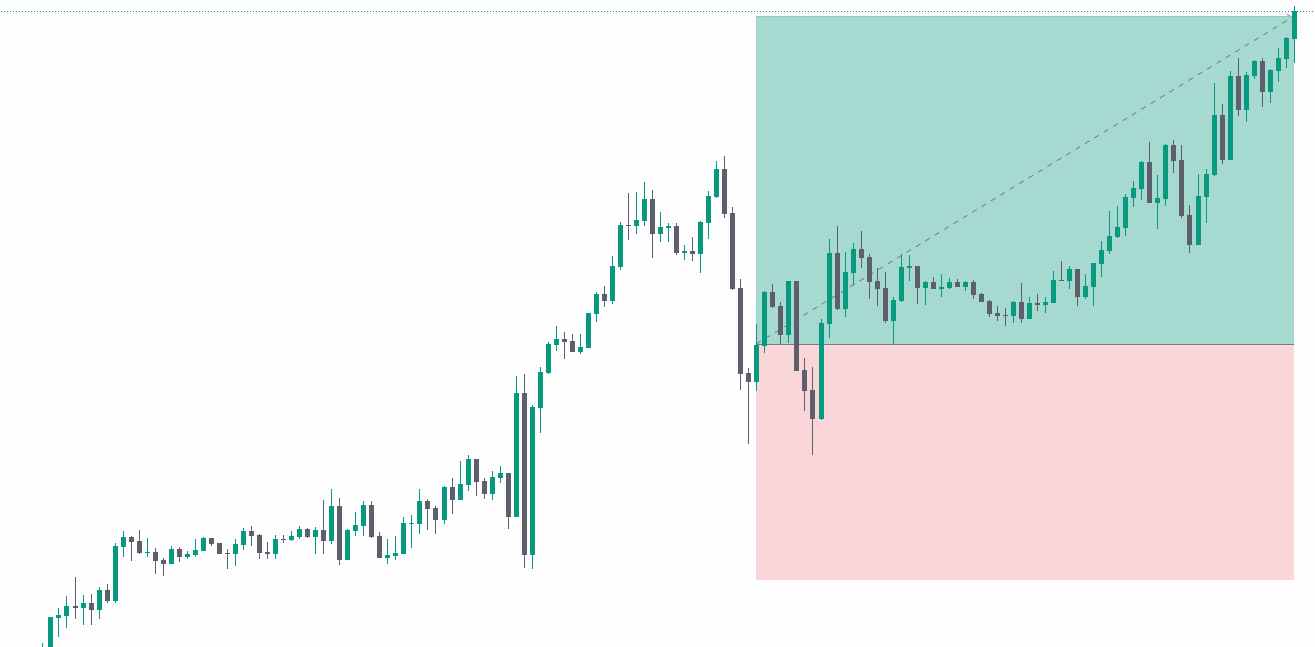

In this case, we are in an uptrend, and we just pulled back. Now it looks like the pullback is ending, and you want to enter to catch the next move up. Where do you place your stop loss?

Some might see this as a good opportunity to get a high risk/reward and place their stop just below the previous low, like this:

This is over a 3:1 risk/reward ratio. Great if your target is achieved. However…

You got stopped out right before the big move. You were right, but you missed out on it because your stop loss was too tight. You need to have a clear thesis statement so you don’t get caught in these kinds of mistakes.

In this example, we are in an uptrend. By definition, this means we are making higher lows and higher highs:

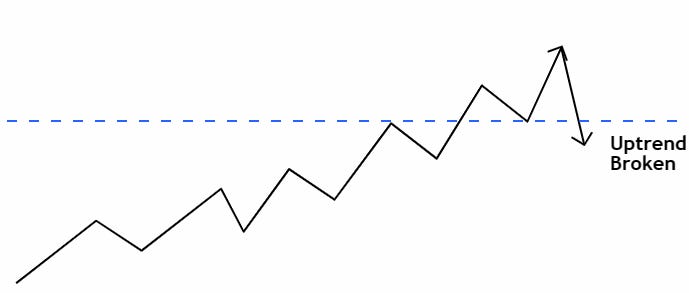

If we break under the previous higher low, we are no longer in an uptrend:

In our example, we expect the uptrend to continue. The uptrend is valid as long as we don’t break under our previous lower high. For the correct stop loss placement, we would need to put it under our previous lower high. In this case, our risk/reward is now 1.4:1. Doesn’t feel as cool as a 3:1 risk/reward ratio, but it works. We had a far lower chance of being stopped.

Know your setup well and have a clear point of failure. If you don’t know these two things, you have a high chance of being stopped unnecessarily. The market is always trying to seek and trap unprepared retail traders, and there are always so many. Don’t fail like everyone else - aim for realistic, steady profits.

You’d be surprised at how good your setups turn out when you follow them exactly how they should be. Most traders aren’t able to follow their plan, despite knowing it’ll work. All you need to do is create a solid plan and make sure your stop is at a place that would invalidate your setup.

If you’re not sure about your setup or failure points, keep studying and practicing until you do. My supply and demand strategies have a built-in stop loss which rarely gets hit if my setup is right. If you’re interested in learning how, here’s a good place to start:

Know your plan and follow it well.. good luck!

- Tradewriter

Disclaimer: Any content from this newsletter should not be taken as financial or investment advice, but for informational and entertainment purposes only. This newsletter simply shares my personal opinions. Investing in stocks, bonds, futures, options, and other securities carries significant risks. Some or all capital may be lost. With leveraged instruments, losses may exceed initial capital. Past performance of a security does not guarantee future results. Consult with a registered financial/investment professional. This newsletter and its authors are not licensed financial/investment professionals. By reading and using this newsletter, as well as any other publications, you are agreeing to these terms.